All Categories

Featured

Table of Contents

Negligence Vet Insurance: Prices around$350 for a protection of$1 million to $3 million. However these are all estimated expenses that vary from area to region. The easiest way to get an estimate of what insurance coverage costs will be for your technique is to get a totally free quote online. There are several on-line sources you can seek advice from for the same.

A few of them are: Hartford Veterinary Insurance Policy Nationwide Insurance Policy Insurance321 AP Intego State Farm Your vet practice needs to be guaranteed. You can also talk to the state department of insurance where you live to obtain some aid. You obtain the concept: You require insurance for your veterinarian facility.

The AVMA supports pet wellness insurance coverage plans that: Need a veterinarian-client-patient relationship. Enable policy holders to choose their own vets, consisting of specialists and emergency and critical care centers. Are accepted by the state insurance coverage regulative firm where the policy is sold.

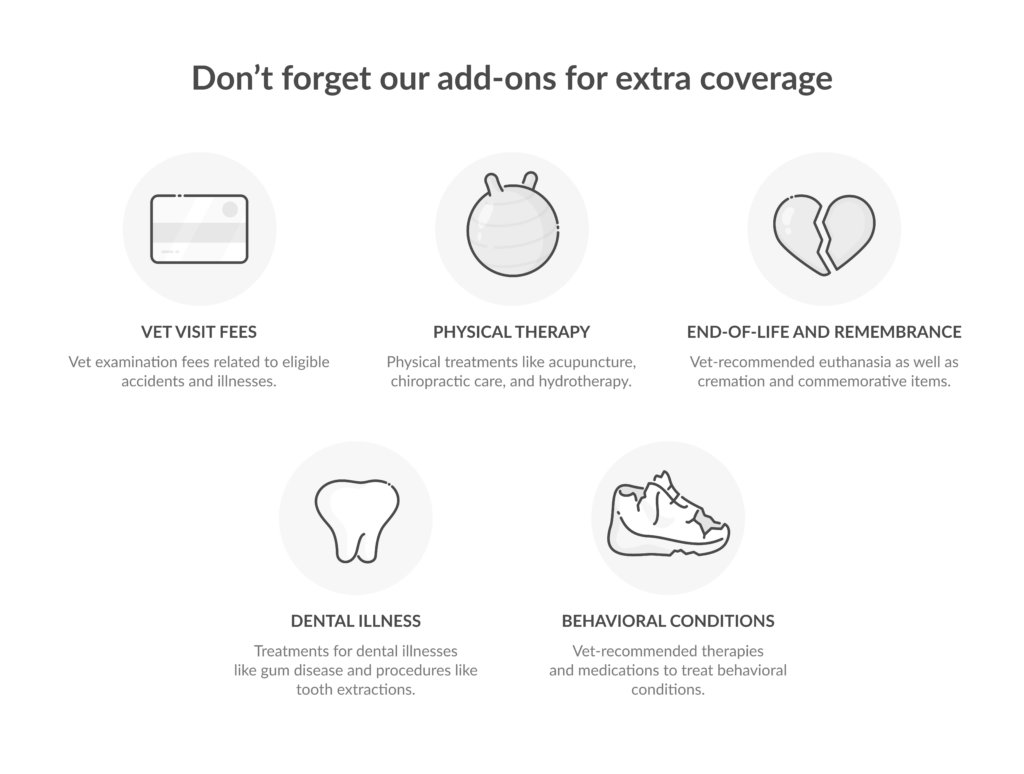

For all conditions see. Preventive Care insurance coverage repayments are based on a schedule. Complete Protection compensations are based upon the billing.

How Pet Insurance By Nationwide® - America's Best Pet & Vet Insurance can Save You Time, Stress, and Money.

You likely have a higher income to secure as a veterinarian, yet what would certainly take place if you could not function beginning tomorrow? Handicap insurance policy guarantees you can safeguard yourself and your family needs to the unimaginable occur. There are numerous alternatives for special needs insurance, consisting of brief and long-term choices. This overview will certainly cover every little thing you must know when choosing the right plan.

But veterinarians also have the problem of pupil fundings. The typical vet leaves college with $179,505 in pupil car loan debt. How would certainly you repay it if you are not able to function? Any kind of occupation postures dangers to its workers, and any can experience things like cardiac arrest or stroke. Veterinarians face various other specific threats and have the 2nd highest occurrence of workplace injuries, beside individuals functioning in nursing homes.

Each insurance coverage business has various demands, but below's what to anticipate overall. The older you are when you apply for disability insurance coverage, the a lot more it might set you back.

Some offer short-term insurance coverage, and others offer long-term insurance coverage. Normally, the insurance coverage isn't adequate to be financially safe and secure, but it might supplement your specific coverage and lower your total out-of-pocket expenses. The great point concerning company insurance coverage is there isn't any kind of underwriting. The disadvantage, nevertheless, is the plan isn't portable.

Getting The Veterinarians - Metlife Pet Insurance To Work

If you have a number of years of income conserved, you may opt for a longer removal duration to keep your costs reduced. Obviously, don't select an elimination period that will create economic pressure. The benefit duration refers to how much time you 'd get disability settlements as long as you are disabled.

Of course, you should purchase a policy that will give adequate protection. You can determine the best advantage period by computing the number of years you can endure monetarily without income and how much you are from retired life. The older you are (closer to retirement), the shorter the advantage duration you may need.

If the plan does not have the benefits you need, you can include riders for an additional expense. Be sure the plan you choose has the coverage choices you require should the unthinkable take place. No 2 vets need the very same amount of impairment insurance policy coverage. In basic, you must cover at least 60% of your revenue.

The smart Trick of Pet Care Credit Card And Financing - Carecredit That Nobody is Talking About

No one can anticipate the future, and it's much better to be risk-free than sorry. Getting adequate impairment insurance coverage ensures you can cover your everyday expense of living and financial debts and secure your family members throughout times of dilemma. Share:.

Latest Posts

Things about Pumpkin For Veterinarians - Pumpkin Pet Insurance